With years of experience of full product design, NWI has the knowledge that can mitigate major supply chain issues even during a pandemic. Visit us or drop us a line - we will be happy to hear from you and to explore a possible collaboration.

Good News About COVID-19’s Impact on the Electronic Supply Chain

Like all parts of the global economy, the electronic supply chain was disrupted by the COVID-19 pandemic and the accompanying lockdowns around the world. There were numerous projections and speculations at the time about how supply chains and the industry might be impacted (including our own take on how the microelectronics industry would be affected). But nine months in, just how have the disruptions in the electronic supply chain been experienced?

What do they mean for the industry in the near and longer terms? While 2020 hasn’t been chock-full of positive stories, there is actually some good news (for a change) about the global electronic supply chain and how it’s fairing in the wake of the pandemic.

Fundamentally, the industry has had an incredibly resilient response to an unprecedented disruption of supply chains, and despite the challenges, the pandemic has offered us all an opportunity to learn and improve on our existing processes.

Thanks to the research of Dale Ford, the Chief Analyst with the Electronic Components Industry Association (ECIA), we have a glimpse into the thinking of the industry across the board since February 2020, when the ECIA started to study the impact of the pandemic. This information was presented as well on EP&T’s COVID-19: Impact on Electronics Supply Chain webinar on October 8th 2020

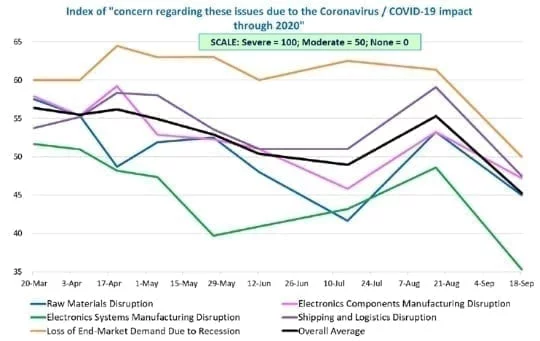

Levels of Industry Concern Dropping

While oscillating and cyclical in nature, see the graph below, the overall levels of industry concern about the state of COVID-19’s impacts on supply chains show a remarkable drop off in September 2020, after a resurgence of pandemic-related concern in August. Most notably, the decline in concern about the "loss of end-market demand due to the recession" took a dramatic dip after being stubbornly high since the beginning of the pandemic. On top of that, all measures of concern across the industry were either at or below their lowest level since the start of the pandemic.

COVID-19 impact on certain electronic supply chain issues. © ECIA 2020

On-Time Delivery to Customers by Distributors and OEM

This graph below presents the impact of the pandemic for the on-time delivery of electro-mechanical components, passive, and semiconductors.

COVID-19 impact on on-time deliveries. © ECIA 2020

As you can see, the electro-mechanical components and passive supply segments of the industry report only minimal to moderate impact of the pandemic on their on-time delivery at this point in the year. You will also note that semiconductors have reported an on-going struggle to produce meaningful data about the impact of the pandemic on their delivery, resulting in poor visibility for the sector and no ability to draw conclusions.

Quarantine’s Impact on Workforce and Operations

While there was certainly an initial period of adjustment as companies got a suddenly remote workforce up and running, in another good news story more than 50% of respondents feel this ‘new normal’ has not impeded their operations throughout the pandemic period. When you factor in those companies who feel the quarantine has had only a minimal to moderate impact, you account for fully 85% of the industry who have felt little to no impact of the lockdown restrictions on their workforce or operations.

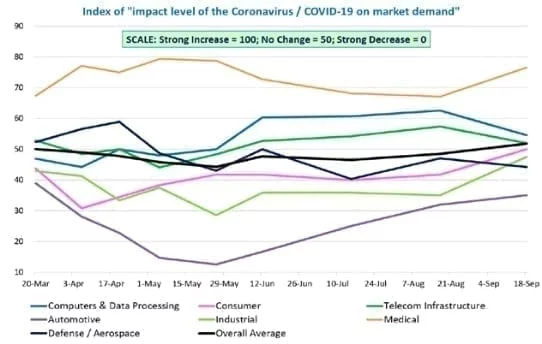

Impacts on Market Demand

As with other areas, COVID-19 has sped up or exacerbated challenges and changes that various industry segments were already experiencing before the pandemic.

COVID-19 impact on market demand. © ECIA 2020

The automotive sector, for example, was struggling prior to the pandemic and it is the industry that has had the hardest time bouncing back during the lockdown, though it is beginning to show some signs of life at last.

As might be expected, the medical equipment sector has seen a strong surge in demand, including in the consumer electronics space as people try to monitor their health at home via devices like clip-on finger O2 monitors and the like.

Likewise, not surprising is the increase for the computers and telecom infrastructure sectors, which saw an increase in demand that matches the work-from-home trend spurred by the pandemic.

Long-Term Outlooks for the Work Force

More than 80% of companies have established an Internal Advisory Group to help establish their COVID-19 responses and develop best practices for the business.

One outcome of these groups has been discussion of near- to long-term changes for the workforce. Throughout the rest of 2020 and well into 2021, between 25% and 75% of workers will continue to work remotely. As expected, operations and engineering report the smallest percentage of remote work capability, while sales and marketing staff are able to perform remotely better.

Worldwide Revenue Growth

While almost everybody expected a double-digit decrease due to the pandemic in 2020, the market has shown tremendous resilience and even recovered relative to the poor performance many sectors experienced in 2019. To date in 2020, capacitors and inductors have seen a smaller than anticipated decrease, while semiconductors and resistors have actually demonstrated small levels of growth in the first half of 2020.

Worldwide Revenue Growth. © ECIA 2020

Part of this expansion is due to an increase of new orders in August, including the first growth in foreign client demand in 2020. According to IHS Markit, the growth rate has been solid, with the pace of increase the quickest in four years.

Likewise, producers have expanded their workforces for the first time since February, with the rate of employment growth the fastest since March 2019. The hiring is due to increased demand for production and growing backlogs of work as orders picked up.

At the same time, producers report accelerated cost pressures amidst raw material shortages and supplier price hikes. While cost pressures were the steepest since early-2019, there is limited flexibility to raise output charges as companies look to retain clients in challenging economic times.

GDP Forecast Scenarios

There are many letters and scenarios used to predict potential the GDP behaviour in the upcoming months. Perhaps you’ve heard the idea of a “V-shaped recovery” being tossed around—the idea that just as there was a deep, sharp downturn in markets in early 2020, that there would be an equally steep, high upswing that will return markets to pre-pandemic levels.

Optimists hope for this kind of “swoosh recovery,” but the truth is that there are no realistic scenarios in which we return to pre-pandemic Q4 2019 levels for at least another two to three years. The economy will likely stall in Q4 2020 but that slow down should be short and be followed by sustained growth in Q1 2021 and afterward.

Trade Winds Are Changing

The pandemic has led to growing concerns about reliance on components manufactured in Asia. Disruptions in China and elsewhere had immediate and profound knock-on effects in the global electronics supply chain.

In light of this, there are now a number of different options being considered by manufacturers and suppliers as to how such vulnerability to disruption can be minimized and redundancy built into the supply chain. These include the idea of on-shoring or re-shoring some or all key elements in a supply chain, to ‘sure-shoring’, which would bring component manufacturing closer to the end-device market. Even prior to the pandemic, 2019 data shows that these kinds of adjustments to supply chains were already being made, and the pandemic will only accelerate this trend as supply chain partners seek to ensure a stable environment for their businesses and confidence that they will be able to meet market demands without disruption.

So the silver lining in all this for electronics supply chains is that despite short-term pain and uncertainty at the beginning of the pandemic, the impacts on workers, companies, and markets in the chain appear to be not so severer, with strong indications that a lasting recovery is not far in the offing.